机构投资人持股和股东

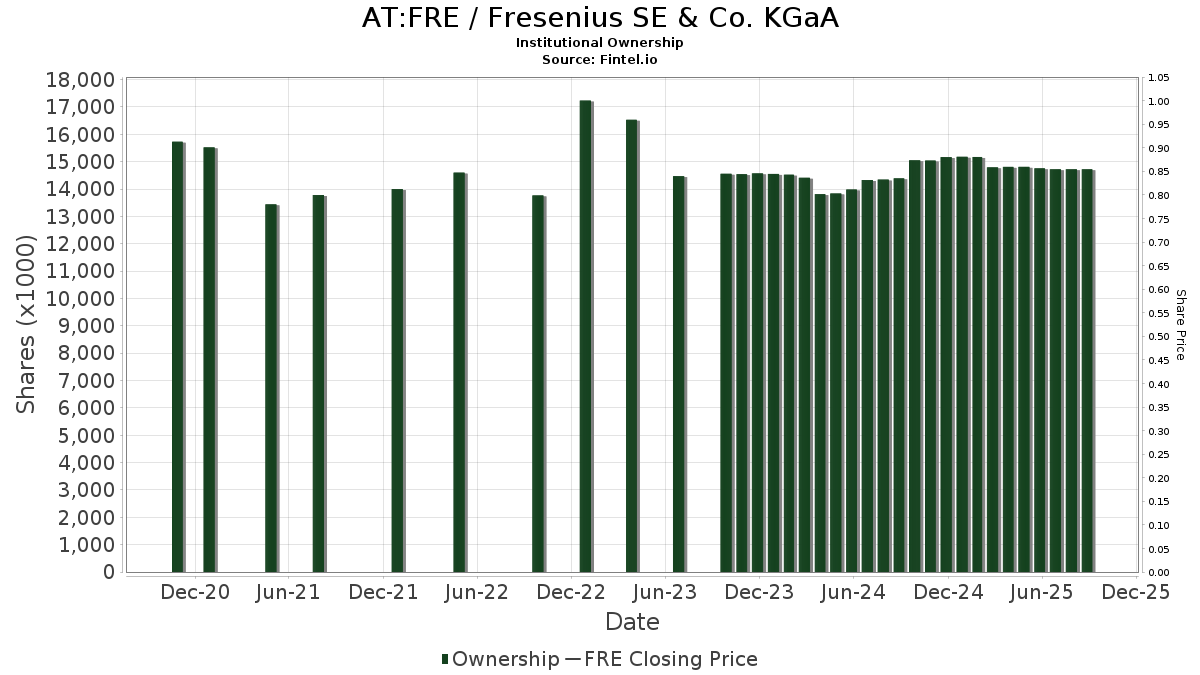

Fresenius SE & Co. KGaA (AT:FRE) 有 37 已向美国证券交易委员会(SEC)提交13D/G或13F表格的机构股东和股东。 这些机构共持有 14,483,828 股股票。 最大股东包括 VGTSX - Vanguard Total International Stock Index Fund Investor Shares, VTMGX - Vanguard Developed Markets Index Fund Admiral Shares, VEURX - Vanguard European Stock Index Fund Investor Shares, VTRIX - Vanguard International Value Fund Investor Shares, VEU - Vanguard FTSE All-World ex-US Index Fund ETF Shares, TCIEX - TIAA-CREF International Equity Index Fund Institutional Class, VT - Vanguard Total World Stock Index Fund ETF Shares, VIHAX - Vanguard International High Dividend Yield Index Fund Admiral Shares, NOINX - Northern International Equity Index Fund, and MSTFX - Morningstar International Equity Fund .

Fresenius SE & Co. KGaA (WBAG:FRE)机构投资人持股结构显示了机构和基金在公司中的当前头寸,以及头寸规模的最新变化。主要股东可以包括个人投资者、共同基金、对冲基金或机构。附表13D表明投资者持有(或之前持有)公司5%以上的股份,并打算(或打算)积极寻求改变业务战略。附表13G表示消极投资超过5%。

基金情绪分数

基金情绪分数(fka 持股累积分数)找到基金买入最多的股票。它是复杂的多因素量化模型的结果,该模型确定了具有最高机构积累水平的公司。分数模型结合使用已披露持有人的总增长、这些持有人的投资组合配置变化以及其他指标。该数字的范围从 0 到 100,数字越大表示对等方的积累水平越高,50 是平均值。

更新频率:每日

13F和NPORT备案

关于13F备案的详细信息是免费的。NP备案的详细信息需要高级会员资格。 绿色行表示新头寸。 红色行表示平仓。 点击链接图标查看完整的交易历史记录。

更新

解锁高级数据并导出到Excel ![]() .

.

| 文件日期 | 来源 | 投资者 | 类型 | 平均价格 (Est) |

股份 | Δ 股份 (%) |

报告 价值 ($1000) |

Δ 价值 (%) |

投资组合配置 (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-06-26 | NP | MSTFX - 晨星国际股票基金 | 99,200 | -22.44 | 4,712 | -3.74 | ||||

| 2025-08-27 | NP | BBIEX - Bridge Builder 国际股票基金 | 24,133 | -1.24 | 1,214 | 16.40 | ||||

| 2025-08-26 | NP | NOINX - 北方国际股票指数基金 | 126,831 | 4.54 | 6,379 | 23.32 | ||||

| 2025-06-30 | NP | VGTSX - Vanguard Total International Stock Index Fund 投资者份额 | 5,829,800 | 1.08 | 276,898 | 25.47 | ||||

| 2025-08-11 | NP | CMIUX - 六环管理股票投资组合国际无限制基金 | 25,441 | 18,470.07 | 1,280 | 31,900.00 | ||||

| 2025-07-29 | NP | VSGX - Vanguard ESG International 股票 ETF ETF 股票 | 73,082 | 1.83 | 3,582 | 24.82 | ||||

| 2025-06-30 | NP | VEURX - 先锋欧洲股票指数基金投资者股票 | 935,679 | 21.04 | 44,442 | 50.23 | ||||

| 2025-06-30 | NP | VEU - 先锋富时全球(美国除外)指数基金 ETF 股票 | 854,168 | 3.06 | 40,570 | 27.92 | ||||

| 2025-08-29 | NP | JAFVX - 战略股权配置信托系列资产净值 | 49,014 | -9.42 | 2,467 | 6.75 | ||||

| 2025-08-21 | NP | MXIVX - 大西部国际价值基金投资者类别 | 42,800 | 0.00 | 2,154 | 17.84 | ||||

| 2025-08-26 | NP | GIEYX - 国际股票基金机构 | 3,215 | 0.00 | 162 | 17.52 | ||||

| 2025-03-31 | NP | VIHAX - 先锋国际高股息收益率指数基金 Admiral Shares | 262,911 | 1.36 | 10,060 | 6.23 | ||||

| 2025-07-29 | NP | LYRWX - Lyrical International价值股票基金机构类 | 1,987 | 97 | ||||||

| 2025-06-30 | NP | VTRIX - 先锋国际价值基金投资者股票 This fund is a listed as child fund of Vanguard Group Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 869,945 | -18.84 | 41,320 | 0.73 | ||||

| 2025-08-21 | NP | MXINX - 大西部国际指数基金投资者类别 | 63,252 | 0.00 | 3,183 | 17.89 | ||||

| 2025-08-25 | NP | QCVAX - Clearwater 国际基金 | 6,137 | 0.00 | 309 | 18.01 | ||||

| 2025-06-30 | NP | VT - Vanguard Total World Stock Index Fund ETF 股票 | 273,524 | 5.38 | 12,992 | 30.80 | ||||

| 2025-08-11 | NP | CIUEX - 六环国际无约束股票基金 | 68,601 | -39.25 | 3,452 | -28.40 | ||||

| 2025-08-26 | NP | NMIEX - Active M 国际股票基金 | 10,386 | -70.47 | 522 | -70.48 | ||||

| 2025-08-27 | NP | BBTIX - Bridge Builder 税务管理国际股票基金 | 45,790 | 0.00 | 2,304 | 17.91 | ||||

| 2025-07-28 | NP | TIEUX - 国际股票基金 | 11,637 | 5.64 | 571 | 29.55 | ||||

| 2025-06-30 | NP | WLDR - Affinity World Leaders 股票 ETF | 1,586 | -29.89 | 75 | -12.79 | ||||

| 2025-08-26 | NP | NOIGX - 北方国际股票基金 | 2,455 | -32.76 | 123 | -20.65 | ||||

| 2025-08-29 | NP | JVANX - 国际股票指数信托资产净值 | 15,063 | 1.67 | 758 | 19.94 | ||||

| 2025-08-22 | NP | 欧洲股票基金公司/马里兰州 | 46,685 | -3.51 | 2,338 | 13.66 | ||||

| 2025-07-29 | NP | BLES - 激励全球希望 ETF | 6,966 | -20.20 | 341 | -2.01 | ||||

| 2025-05-30 | NP | MML系列投资基金 - MML国际股票基金II类 | 35,100 | -17.22 | 1,496 | 1.63 | ||||

| 2025-07-29 | NP | WWJD - Inspire International ESG ETF | 35,717 | -13.73 | 1,751 | 6.00 | ||||

| 2025-08-29 | NP | PPYIX - PIMCO RAE 国际基金机构类 | 50,705 | 20.97 | 2,552 | 42.59 | ||||

| 2025-05-29 | NP | MOSAX - 万通精选海外基金 A 类 | 57,300 | -32.35 | 2,443 | -17.00 | ||||

| 2025-08-26 | NP | GIIYX - 国际机构股票指数基金 | 57,197 | 0.00 | 2,878 | 17.90 | ||||

| 2025-08-21 | NP | MXECX - Great-West 核心策略:国际股票基金机构类 | 25,285 | -24.68 | 1,272 | -11.24 | ||||

| 2025-08-29 | NP | MFDX - PIMCO RAFI 动态多因素国际股票 ETF | 9,493 | 23.19 | 478 | 45.43 | ||||

| 2025-06-26 | NP | JHMD - 约翰汉考克多因素开发的国际 ETF | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-07-29 | NP | John Hancock Funds II - 国际战略股票配置基金类别资产净值 | 61,474 | 10.30 | 3,013 | 35.19 | ||||

| 2025-07-22 | NP | DIEFX - 目的地国际股票基金 I 类 | 6,976 | -15.01 | 342 | 4.27 | ||||

| 2025-06-26 | NP | TCIEX - TIAA-CREF 国际股票指数基金机构类别 | 687,109 | -2.68 | 32,636 | 20.80 | ||||

| 2025-05-28 | NP | QCSTRX - 股票账户类别 R1 | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-27 | NP | VTMGX - 先锋发达市场指数基金 Admiral Shares | 3,707,184 | 2.40 | 186,556 | 20.69 |