机构投资人持股和股东

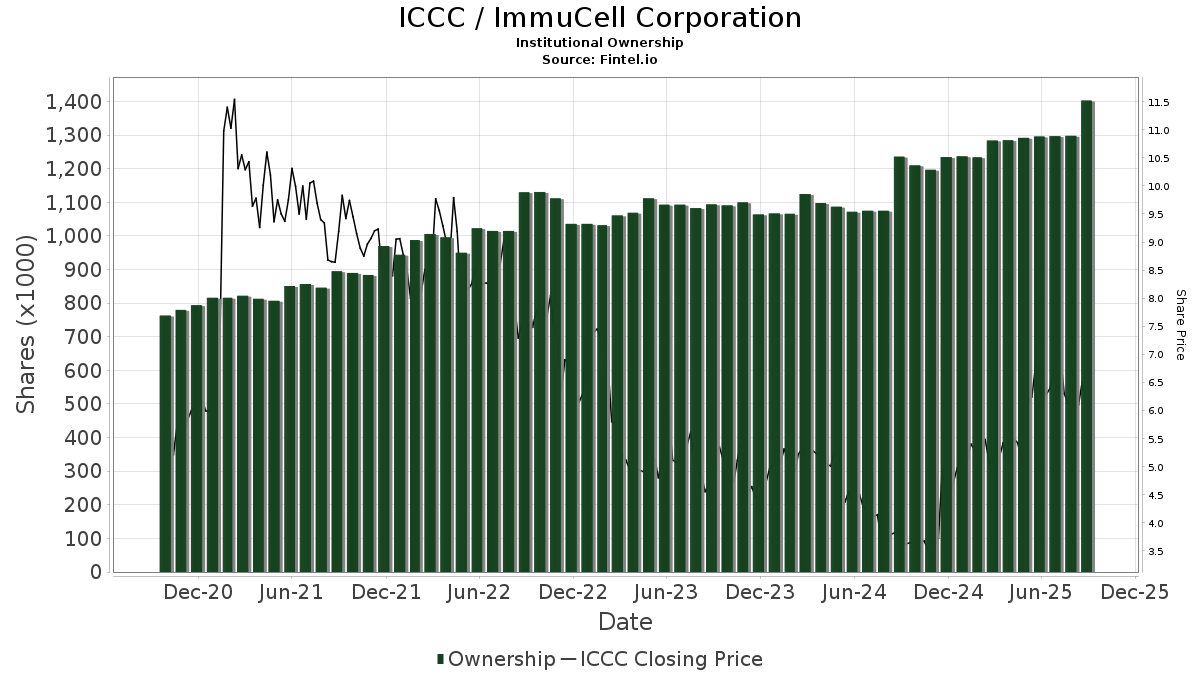

ImmuCell Corporation (US:ICCC) 有 48 已向美国证券交易委员会(SEC)提交13D/G或13F表格的机构股东和股东。 这些机构共持有 1,403,567 股股票。 最大股东包括 Vanguard Group Inc, VTSMX - Vanguard Total Stock Market Index Fund Investor Shares, Renaissance Technologies Llc, Cresset Asset Management, LLC, VEXMX - Vanguard Extended Market Index Fund Investor Shares, Morgan Stanley, Bleichroeder LP, Dauntless Investment Group, LLC, Geode Capital Management, Llc, and Dimensional Fund Advisors Lp .

ImmuCell Corporation (NasdaqCM:ICCC)机构投资人持股结构显示了机构和基金在公司中的当前头寸,以及头寸规模的最新变化。主要股东可以包括个人投资者、共同基金、对冲基金或机构。附表13D表明投资者持有(或之前持有)公司5%以上的股份,并打算(或打算)积极寻求改变业务战略。附表13G表示消极投资超过5%。

The share price as of September 11, 2025 is 6.13 / share. Previously, on September 12, 2024, the share price was 3.62 / share. This represents an increase of 69.34% over that period.

基金情绪分数

基金情绪分数(fka 持股累积分数)找到基金买入最多的股票。它是复杂的多因素量化模型的结果,该模型确定了具有最高机构积累水平的公司。分数模型结合使用已披露持有人的总增长、这些持有人的投资组合配置变化以及其他指标。该数字的范围从 0 到 100,数字越大表示对等方的积累水平越高,50 是平均值。

更新频率:每日

13D/G备案

由于SEC的处理方式不同,我们将13D/G备案与13F备案分开提交,13D/G备案可以由投资者群体(一个主导)提交,而13F备案不能。这导致投资者可以提交13D / G报告总股份的一个价值(代表投资者群体拥有的所有股份),但随后提交13F报告总股份的不同价值(严格代表他们自己的持股)。这意味着13D/G备案和13F备案的持股通常没有直接可比性,因此我们单独提供它们。

注意:自 2021 年 5 月 16 日起,我们不再显示在过去一年内未提交 13D/G 的持有人。以前,我们显示了13D / G申请的完整历史记录。一般来说,需要提交13D / G备案的实体必须在提交交割备案之前至少每年提交一次。但是,基金有时会在没有提交交割备案的情况下退出头寸(即,它们逐渐减少),因此显示完整的历史记录有时会导致对当前持股的混淆。为防止混淆,我们现在只显示“当前”持有人,即在过去一年内提交申请的持有人。

Upgrade to unlock premium data.

| 文件日期 | 表格 | 投资者 | 前期 股票 |

最新 股票 |

Δ 股票 (Percent) |

持股 (百分比) |

Δ 持股 (百分比) |

|

|---|---|---|---|---|---|---|---|---|

| 2024-09-17 | Srk 基金 I,LP。 | 391,322 | 502,258 | 28.35 | 6.40 | 28.00 | ||

| 2024-08-27 | 克努森·埃纳尔 A III | 463,619 | 5.90 |

13F和NPORT备案

Other Listings

| DE:IUL | €5.20 |