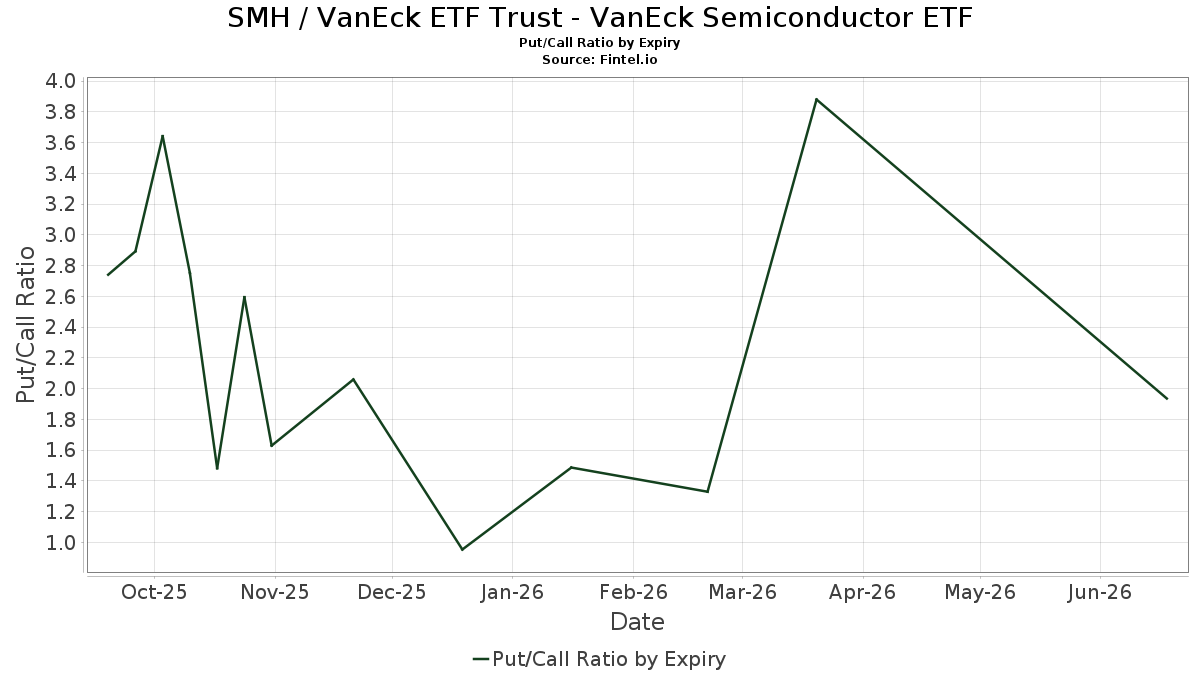

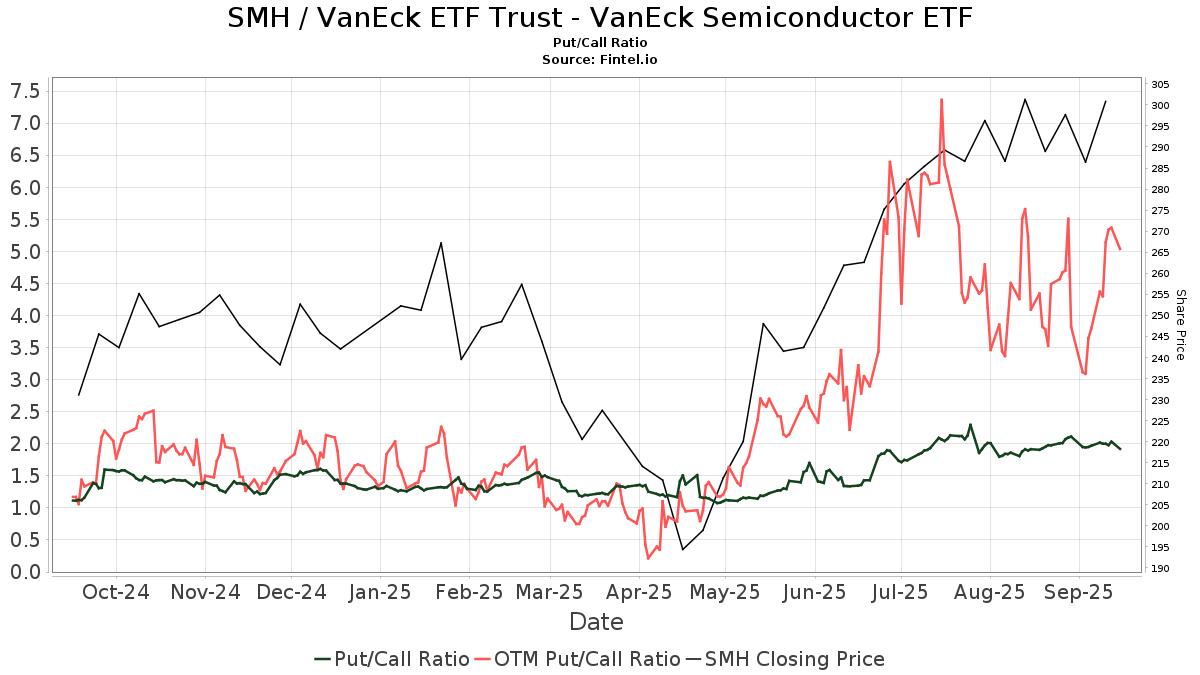

看跌与看涨期权比率 - 预测和历史

SMH / VanEck ETF Trust - VanEck Semiconductor ETF的看跌与看涨期权比率为2.05。 看跌与看涨期权比率显示已披露的未平仓看跌期权头寸总数除以未平仓看涨期权头寸。由于看跌通常是看跌押注,看涨则是看涨押注,因此看跌与看涨期权比率大于1表示看跌情绪,比率小于1表示看涨情绪。

更新频率:每日

异常期权活动 - 交易量

看跌与看涨期权比率显示已披露的未平仓看跌期权头寸总数除以未平仓看涨期权期权头寸。由于看跌期权通常是看跌押注,而看涨期权是看涨押注,因此看跌与看涨期权比率大于1表示看跌情绪,小于1的比率表示看涨情绪。

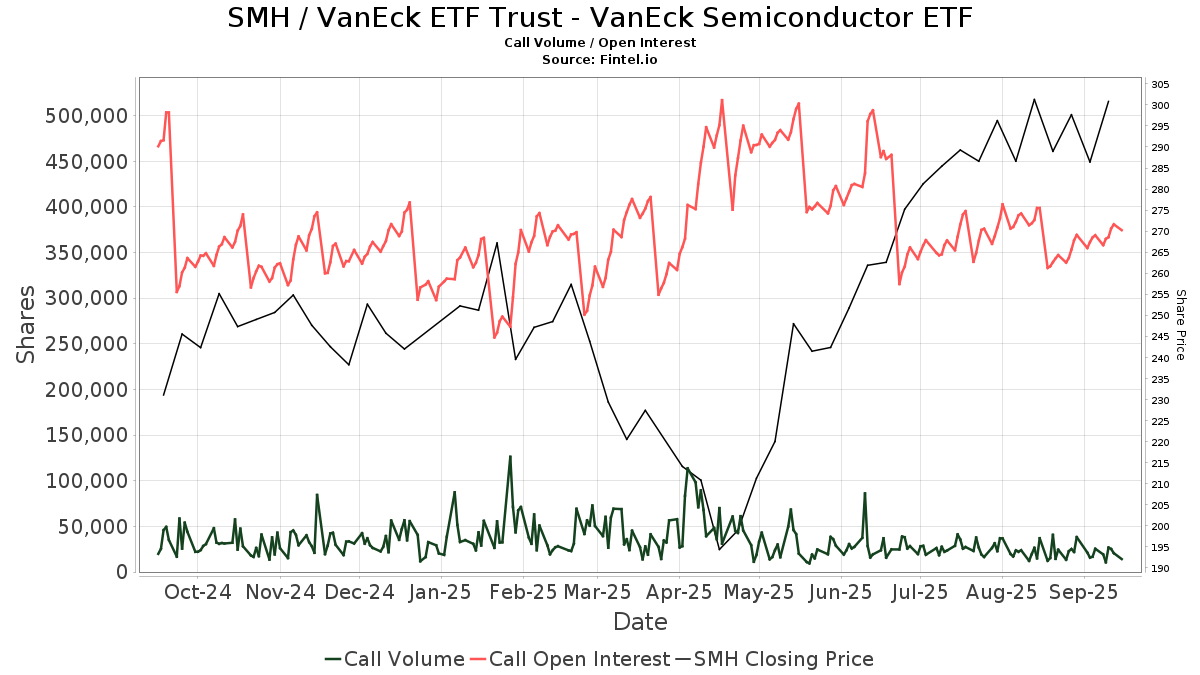

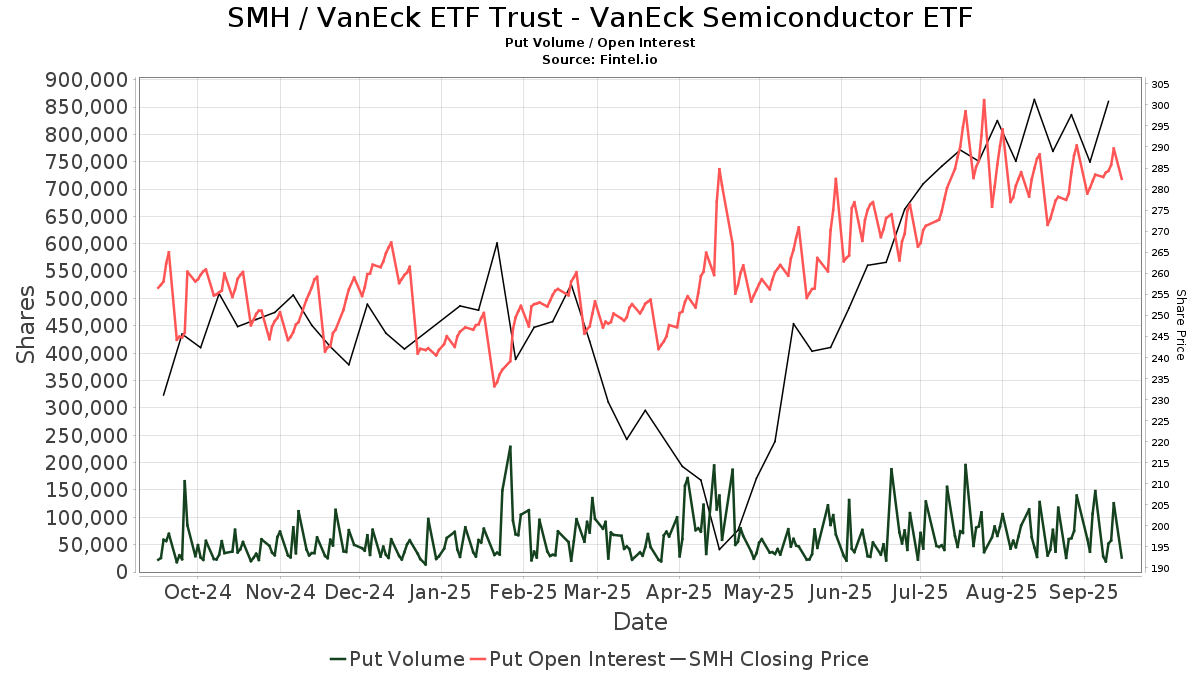

异常期权活动(UOA)通常被认为是价格方向变动的强烈信号。异常期权活动的一个指标是看跌期权或看涨期权的总份额除以同一期权类型的未平仓头寸。如果看涨或看跌期权的总份额超过当前的未平仓头寸,则被认为是不寻常的,并表明一个强大的方向信号。在下表中,期权交易量超过当前未平仓头寸的任何日期都以绿色(看涨期权)或红色(看跌期权)突出显示。

例如,如果在任何交易日,看涨交易量超过当前看涨未平仓头寸,则看涨交易量/看涨未平仓头寸比率将大于1,并且表中的该单元格将以绿色突出显示。这将表明大量买入看涨期权,这是一个看涨信号。同样,如果情况正好相反 - 看跌交易量超过看跌期权未平仓头寸,则表格单元格将以红色突出显示,并表示强烈的看跌信号。

更新频率:每日

期权希腊值 (Option Greeks) - Delta值, Gamma值, Theta值

更新频率:每日

期权交易量 - 整体市场

更新频率:每日

期权交易量 - 场内

更新频率:每日

| 日期 | CBOE | C2 | EDGX | BZX | PHLX | NASDAQ | BX | GEMX | ISE | MRX | AMEX | ARCA | MIAX | PEARL | EMLD | BOX | 总 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2025-09-09 | 2,494 | 1,029 | 890 | 2,131 | 2,355 | 1,688 | 551 | 1,799 | 3,084 | 484 | 1,660 | 3,655 | 2,190 | 1,095 | 1,325 | 1,157 | 30,009 |

| 2025-09-08 | 3,964 | 2,245 | 1,369 | 1,721 | 7,292 | 1,763 | 385 | 1,670 | 4,051 | 1,278 | 3,398 | 4,540 | 4,891 | 845 | 1,152 | 3,500 | 47,794 |

| 2025-09-05 | 7,198 | 2,923 | 5,911 | 5,398 | 7,874 | 7,720 | 1,789 | 4,187 | 9,458 | 2,086 | 74,284 | 14,491 | 6,513 | 5,672 | 2,534 | 7,523 | 173,383 |

| 2025-09-04 | 22,605 | 3,224 | 4,978 | 4,788 | 8,646 | 2,358 | 557 | 3,168 | 6,173 | 9,781 | 5,011 | 12,768 | 4,411 | 2,410 | 1,953 | 20,814 | 123,123 |

| 2025-09-03 | 5,354 | 1,946 | 2,405 | 2,343 | 3,141 | 2,321 | 704 | 2,174 | 2,793 | 2,412 | 5,228 | 8,274 | 2,435 | 1,423 | 1,382 | 2,558 | 52,827 |

| 2025-09-02 | 17,990 | 3,272 | 3,520 | 2,921 | 8,378 | 4,083 | 654 | 2,299 | 7,180 | 2,019 | 3,833 | 9,667 | 3,993 | 1,241 | 2,390 | 4,041 | 81,833 |

| 2025-08-29 | 13,660 | 7,633 | 4,455 | 6,386 | 11,086 | 9,838 | 2,838 | 4,279 | 13,222 | 3,099 | 49,598 | 14,955 | 8,934 | 3,184 | 3,116 | 8,333 | 177,916 |

| 2025-08-28 | 10,420 | 3,147 | 4,481 | 4,761 | 5,903 | 5,146 | 1,317 | 4,511 | 7,435 | 1,957 | 9,719 | 13,538 | 4,274 | 1,857 | 2,374 | 6,338 | 96,867 |

| 2025-08-27 | 7,987 | 2,959 | 7,799 | 3,637 | 5,297 | 6,563 | 752 | 3,496 | 4,888 | 2,246 | 5,445 | 9,075 | 6,012 | 2,722 | 2,356 | 8,572 | 86,951 |

| 2025-08-26 | 16,037 | 2,391 | 3,094 | 2,793 | 3,782 | 1,588 | 427 | 1,263 | 5,027 | 1,702 | 20,423 | 8,945 | 5,751 | 1,052 | 2,341 | 3,390 | 82,890 |

| 2025-08-25 | 3,836 | 834 | 6,213 | 1,716 | 3,772 | 2,004 | 413 | 850 | 1,439 | 888 | 6,375 | 2,766 | 1,953 | 627 | 1,088 | 2,372 | 39,256 |

| 2025-08-22 | 6,697 | 2,203 | 3,684 | 4,001 | 3,548 | 1,906 | 658 | 2,525 | 4,231 | 1,279 | 89,364 | 5,380 | 3,082 | 2,017 | 2,062 | 4,316 | 141,875 |

| 2025-08-21 | 6,114 | 2,254 | 3,789 | 1,224 | 3,406 | 943 | 508 | 1,365 | 3,275 | 1,670 | 6,444 | 7,067 | 1,839 | 692 | 1,750 | 4,947 | 51,738 |

| 2025-08-20 | 9,148 | 2,803 | 4,958 | 3,924 | 12,740 | 4,656 | 740 | 4,982 | 8,749 | 2,822 | 13,470 | 21,231 | 4,668 | 1,995 | 4,314 | 10,669 | 117,684 |

| 2025-08-19 | 6,699 | 2,197 | 2,558 | 2,036 | 6,964 | 2,955 | 532 | 1,578 | 4,525 | 1,900 | 4,042 | 6,227 | 2,439 | 1,294 | 2,851 | 4,296 | 56,115 |

| 2025-08-18 | 5,482 | 1,099 | 1,256 | 1,268 | 4,974 | 2,397 | 1,117 | 1,000 | 2,497 | 577 | 3,177 | 4,971 | 1,953 | 691 | 1,852 | 3,456 | 42,538 |

| 2025-08-15 | 16,084 | 1,883 | 7,796 | 4,590 | 4,052 | 5,393 | 824 | 4,629 | 5,360 | 1,629 | 78,611 | 14,200 | 5,163 | 2,515 | 1,803 | 5,094 | 164,865 |

| 2025-08-14 | 4,705 | 1,311 | 4,005 | 894 | 2,137 | 1,377 | 304 | 1,716 | 3,463 | 1,144 | 3,445 | 3,473 | 2,244 | 587 | 1,083 | 8,229 | 42,626 |

| 2025-08-13 | 10,487 | 1,122 | 1,934 | 1,503 | 4,755 | 2,227 | 596 | 2,209 | 4,137 | 1,185 | 20,044 | 8,427 | 3,780 | 921 | 1,483 | 4,338 | 71,453 |

| 2025-08-12 | 7,818 | 3,330 | 2,476 | 5,001 | 7,444 | 4,343 | 572 | 1,319 | 7,769 | 1,398 | 7,595 | 14,181 | 4,481 | 2,197 | 2,632 | 4,394 | 83,189 |