基本统计

| 机构股东 | 10 total, 10 long only, 0 short only, 0 long/short - change of -16.67% MRQ |

| 平均投资组合配置 | 0.2919 % - change of 17.17% MRQ |

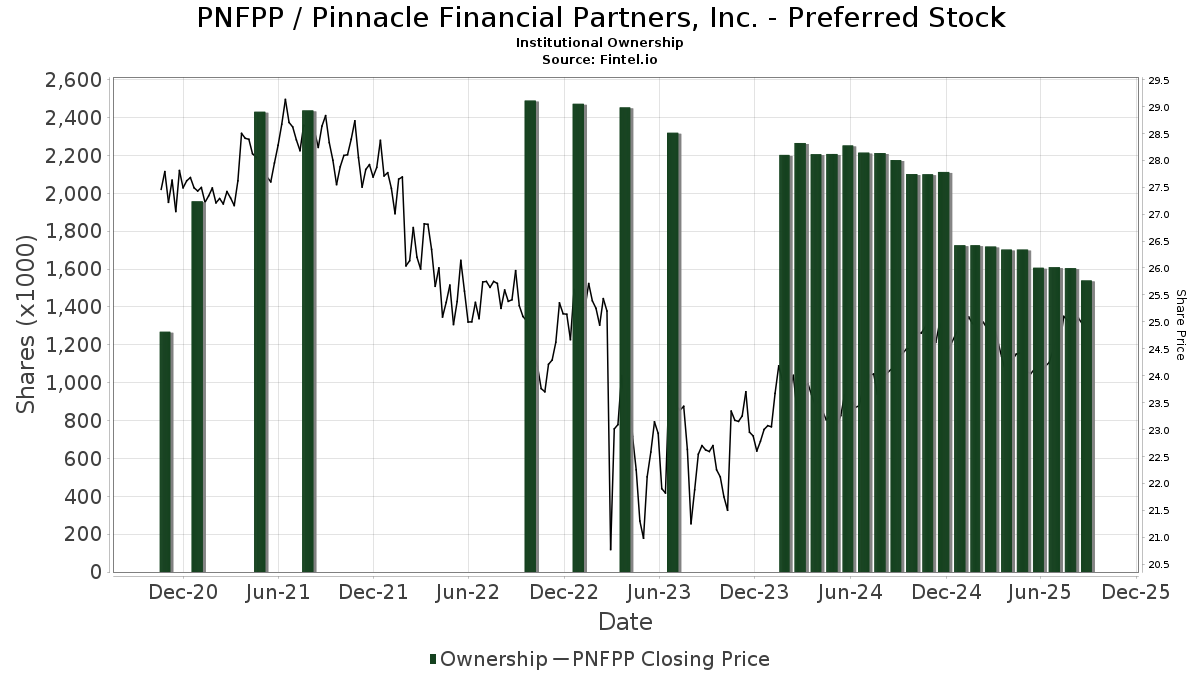

| 法人股(长期) | 1,540,095 (ex 13D/G) - change of -0.07MM shares -4.21% MRQ |

| 制度价值(长期) | $ 37,209 USD ($1000) |

机构投资人持股和股东

Pinnacle Financial Partners, Inc. - Preferred Stock (US:PNFPP) 有 10 已向美国证券交易委员会(SEC)提交13D/G或13F表格的机构股东和股东。 这些机构共持有 1,540,095 股股票。 最大股东包括 PFF - iShares Preferred and Income Securities ETF, FPE - First Trust Preferred Securities and Income ETF, John Hancock Preferred Income Fund, John Hancock Preferred Income Fund Iii, PFLD - AAM Low Duration Preferred and Income Securities ETF, First Trust Intermediate Duration Preferred & Income Fund, John Hancock Preferred Income Fund Ii, John Hancock Financial Opportunities Fund, FPEAX - First Trust Preferred Securities and Income Fund Class A, and Thompson Investment Management, Inc. .

Pinnacle Financial Partners, Inc. - Preferred Stock (NasdaqGS:PNFPP)机构投资人持股结构显示了机构和基金在公司中的当前头寸,以及头寸规模的最新变化。主要股东可以包括个人投资者、共同基金、对冲基金或机构。附表13D表明投资者持有(或之前持有)公司5%以上的股份,并打算(或打算)积极寻求改变业务战略。附表13G表示消极投资超过5%。

The share price as of September 8, 2025 is 24.91 / share. Previously, on September 9, 2024, the share price was 24.11 / share. This represents an increase of 3.32% over that period.

基金情绪分数

基金情绪分数(fka 持股累积分数)找到基金买入最多的股票。它是复杂的多因素量化模型的结果,该模型确定了具有最高机构积累水平的公司。分数模型结合使用已披露持有人的总增长、这些持有人的投资组合配置变化以及其他指标。该数字的范围从 0 到 100,数字越大表示对等方的积累水平越高,50 是平均值。

更新频率:每日

13F和NPORT备案

关于13F备案的详细信息是免费的。NP备案的详细信息需要高级会员资格。 绿色行表示新头寸。 红色行表示平仓。 点击链接图标查看完整的交易历史记录。

更新

解锁高级数据并导出到Excel ![]() .

.