基本统计

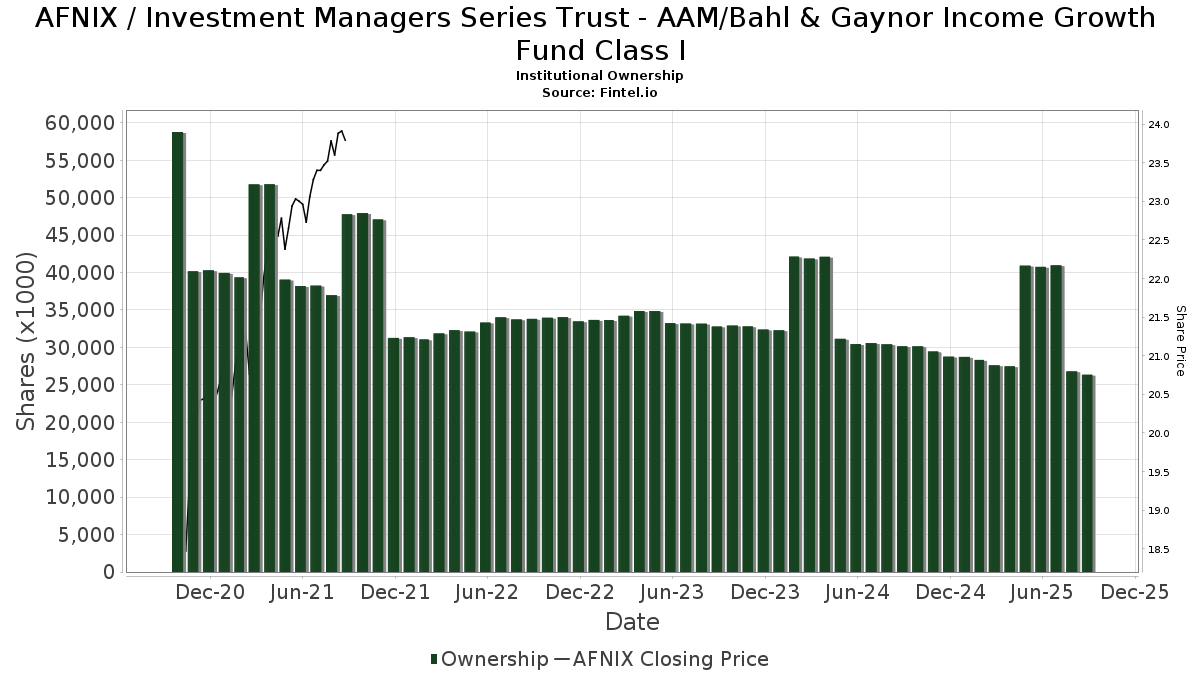

| 机构股东 | 31 total, 31 long only, 0 short only, 0 long/short - change of -6.06% MRQ |

| 平均投资组合配置 | 13.3550 % - change of 3.38% MRQ |

| 法人股(长期) | 26,351,800 (ex 13D/G) - change of -14.41MM shares -35.35% MRQ |

| 制度价值(长期) | $ 1,023,553 USD ($1000) |

机构投资人持股和股东

Investment Managers Series Trust - AAM/Bahl & Gaynor Income Growth Fund Class I (US:AFNIX) 有 31 已向美国证券交易委员会(SEC)提交13D/G或13F表格的机构股东和股东。 这些机构共持有 26,351,800 股股票。 最大股东包括 LINCOLN VARIABLE INSURANCE PRODUCTS TRUST - LVIP Dimensional U.S. Equity Managed Volatility Fund Standard Class, FMUEX - Free Market U.S. Equity Fund Institutional Class, Dfa Investment Dimensions Group Inc - Dimensional 2050 Target Date Retirement Income Fund Institutional Class, Dfa Investment Dimensions Group Inc - Dimensional 2045 Target Date Retirement Income Fund Institutional Class, Dfa Investment Dimensions Group Inc - Dimensional 2040 Target Date Retirement Income Fund Institutional Class, DFA INVESTMENT DIMENSIONS GROUP INC - VA Equity Allocation Portfolio Institutional Class, Dfa Investment Dimensions Group Inc - Dimensional 2055 Target Date Retirement Income Fund Institutional Class, Dfa Investment Dimensions Group Inc - Dimensional 2035 Target Date Retirement Income Fund Institutional Class, Dfa Investment Dimensions Group Inc - Dimensional 2060 Target Date Retirement Income Fund Institutional Class, and Dfa Investment Dimensions Group Inc - Dimensional 2030 Target Date Retirement Income Fund Institutional Class .

Investment Managers Series Trust - AAM/Bahl & Gaynor Income Growth Fund Class I (N/A:AFNIX)机构投资人持股结构显示了机构和基金在公司中的当前头寸,以及头寸规模的最新变化。主要股东可以包括个人投资者、共同基金、对冲基金或机构。附表13D表明投资者持有(或之前持有)公司5%以上的股份,并打算(或打算)积极寻求改变业务战略。附表13G表示消极投资超过5%。

基金情绪分数

基金情绪分数(fka 持股累积分数)找到基金买入最多的股票。它是复杂的多因素量化模型的结果,该模型确定了具有最高机构积累水平的公司。分数模型结合使用已披露持有人的总增长、这些持有人的投资组合配置变化以及其他指标。该数字的范围从 0 到 100,数字越大表示对等方的积累水平越高,50 是平均值。

更新频率:每日