基本统计

| 机构股东 | 9 total, 9 long only, 0 short only, 0 long/short - change of 0.00% MRQ |

| 股价 | 9,260.00 |

| 平均投资组合配置 | 0.0559 % - change of 102.18% MRQ |

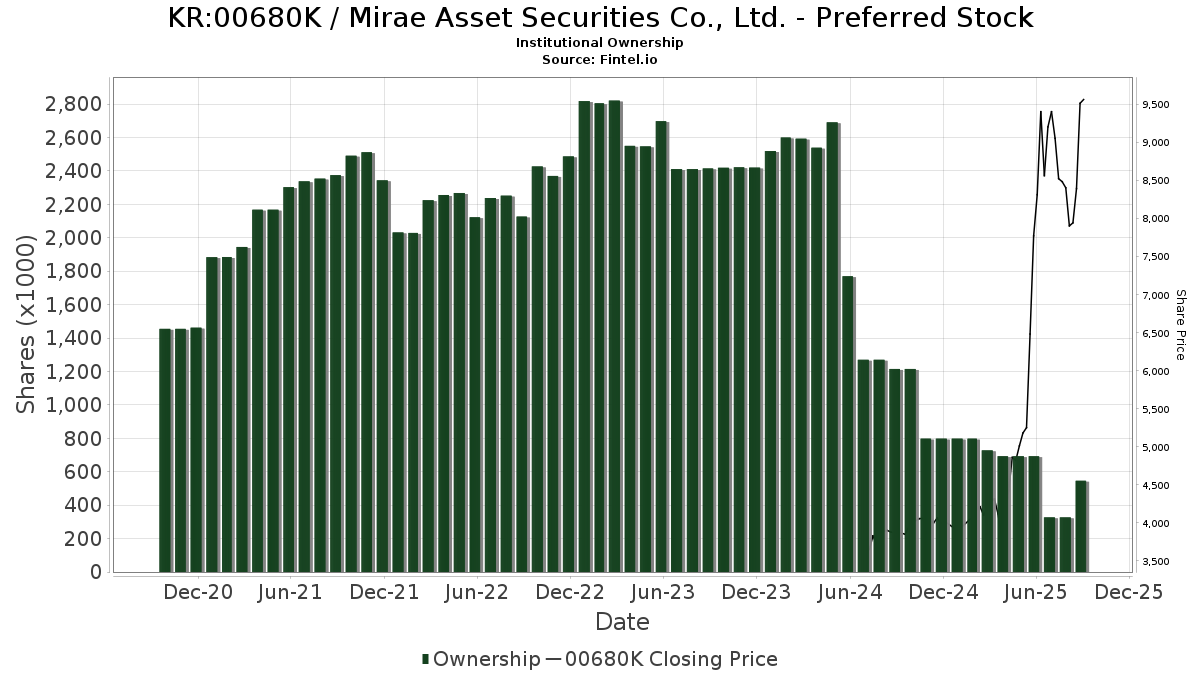

| 法人股(长期) | 546,833 (ex 13D/G) - change of -0.15MM shares -21.10% MRQ |

| 制度价值(长期) | $ 2,518 USD ($1000) |

机构投资人持股和股东

Mirae Asset Securities Co., Ltd. - Preferred Stock (KR:00680K) 有 9 已向美国证券交易委员会(SEC)提交13D/G或13F表格的机构股东和股东。 这些机构共持有 546,833 股股票。 最大股东包括 PACIFIC SELECT FUND - Emerging Markets Portfolio Class I, DAINX - Dunham International Stock Fund Class A, GERIX - Goldman Sachs Emerging Markets Equity Insights Fund Institutional, VT - Vanguard Total World Stock Index Fund ETF Shares, VGTSX - Vanguard Total International Stock Index Fund Investor Shares, NATIONWIDE VARIABLE INSURANCE TRUST - NVIT GS Emerging Markets Equity Insights Fund Class Y, VIHAX - Vanguard International High Dividend Yield Index Fund Admiral Shares, VEU - Vanguard FTSE All-World ex-US Index Fund ETF Shares, and JNL SERIES TRUST - JNL Emerging Markets Index Fund (I) .

Mirae Asset Securities Co., Ltd. - Preferred Stock (KOSE:00680K)机构投资人持股结构显示了机构和基金在公司中的当前头寸,以及头寸规模的最新变化。主要股东可以包括个人投资者、共同基金、对冲基金或机构。附表13D表明投资者持有(或之前持有)公司5%以上的股份,并打算(或打算)积极寻求改变业务战略。附表13G表示消极投资超过5%。

The share price as of September 9, 2025 is 9,260.00 / share. Previously, on September 9, 2024, the share price was 3,915.00 / share. This represents an increase of 136.53% over that period.

基金情绪分数

基金情绪分数(fka 持股累积分数)找到基金买入最多的股票。它是复杂的多因素量化模型的结果,该模型确定了具有最高机构积累水平的公司。分数模型结合使用已披露持有人的总增长、这些持有人的投资组合配置变化以及其他指标。该数字的范围从 0 到 100,数字越大表示对等方的积累水平越高,50 是平均值。

更新频率:每日

13F和NPORT备案

| 文件日期 | 来源 | 投资者 | 类型 | 平均价格 (Est) |

股份 | Δ 股份 (%) |

报告 价值 ($1000) |

Δ 价值 (%) |

投资组合配置 (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-06-30 | NP | VT - Vanguard Total World Stock Index Fund ETF 股票 | 54,755 | 0.00 | 187 | 22.37 | ||||

| 2025-06-30 | NP | VGTSX - Vanguard Total International Stock Index Fund 投资者份额 | 36,379 | 0.00 | 124 | 22.77 | ||||

| 2025-08-27 | NP | JNL 系列信托 - JNL 新兴市场指数基金 (I) | 15,130 | 0.00 | 94 | 129.27 | ||||

| 2025-06-27 | NP | DAINX - 邓纳姆国际股票基金 A 类 | 110,420 | 0.00 | 377 | 22.48 | ||||

| 2025-06-30 | NP | VEU - 先锋富时全球(美国除外)指数基金 ETF 股票 | 21,571 | 0.00 | 74 | 21.67 | ||||

| 2025-08-20 | NP | 全国可变保险信托 - NVIT GS Emerging Markets Equity Insights Fund Y 级 | 33,485 | 106.61 | 208 | 220.00 | ||||

| 2025-06-25 | NP | GERIX - 高盛新兴市场股票洞察基金机构 | 67,065 | -76.43 | 229 | -71.25 | ||||

| 2025-06-30 | NP | VIHAX - 先锋国际高股息收益率指数基金 Admiral Shares | 22,145 | 339.30 | 76 | 435.71 | ||||

| 2025-08-18 | NP | 太平洋精选基金 - 新兴市场投资组合 I 类 | 185,883 | 1,155 | ||||||

| 2025-05-28 | NP | VTMGX - 先锋发达市场指数基金 Admiral Shares | 0 | -100.00 | 0 | -100.00 |