基本统计

| 机构股东 | 10 total, 10 long only, 0 short only, 0 long/short - change of 11.11% MRQ |

| 股价 | 14.60 |

| 平均投资组合配置 | 0.1914 % - change of -8.19% MRQ |

| 法人股(长期) | 2,839,662 (ex 13D/G) - change of -0.21MM shares -7.03% MRQ |

| 制度价值(长期) | $ 46,323 USD ($1000) |

机构投资人持股和股东

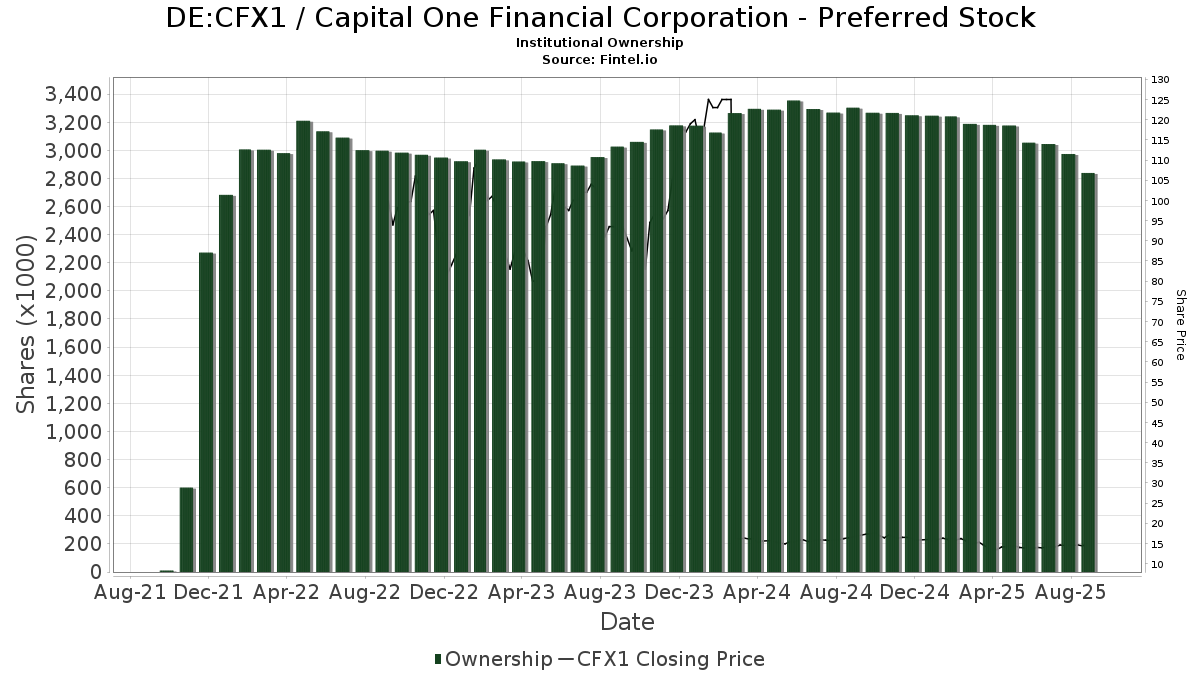

Capital One Financial Corporation - Preferred Stock (DE:CFX1) 有 10 已向美国证券交易委员会(SEC)提交13D/G或13F表格的机构股东和股东。 这些机构共持有 2,839,662 股股票。 最大股东包括 PFF - iShares Preferred and Income Securities ETF, PGX - Invesco Preferred ETF, PFFD - Global X U.S. Preferred ETF, PGF - Invesco Financial Preferred ETF, PSK - SPDR(R) Wells Fargo Preferred Stock ETF, PNARX - Spectrum Preferred and Capital Securities Income Fund (f/k/a Preferred Securities) R-3, QPFF - American Century Quality Preferred ETF, GPRF - Goldman Sachs Access U.S. Preferred Stock and Hybrid Securities ETF, FPFD - Fidelity Preferred Securities & Income ETF, and Pnc Financial Services Group, Inc. .

Capital One Financial Corporation - Preferred Stock (DB:CFX1)机构投资人持股结构显示了机构和基金在公司中的当前头寸,以及头寸规模的最新变化。主要股东可以包括个人投资者、共同基金、对冲基金或机构。附表13D表明投资者持有(或之前持有)公司5%以上的股份,并打算(或打算)积极寻求改变业务战略。附表13G表示消极投资超过5%。

The share price as of September 5, 2025 is 14.60 / share. Previously, on September 9, 2024, the share price was 16.50 / share. This represents a decline of 11.52% over that period.

基金情绪分数

基金情绪分数(fka 持股累积分数)找到基金买入最多的股票。它是复杂的多因素量化模型的结果,该模型确定了具有最高机构积累水平的公司。分数模型结合使用已披露持有人的总增长、这些持有人的投资组合配置变化以及其他指标。该数字的范围从 0 到 100,数字越大表示对等方的积累水平越高,50 是平均值。

更新频率:每日

13F和NPORT备案

关于13F备案的详细信息是免费的。NP备案的详细信息需要高级会员资格。 绿色行表示新头寸。 红色行表示平仓。 点击链接图标查看完整的交易历史记录。

更新

解锁高级数据并导出到Excel ![]() .

.

Other Listings

| US:COF.PRN |